News

13

Jul

2022

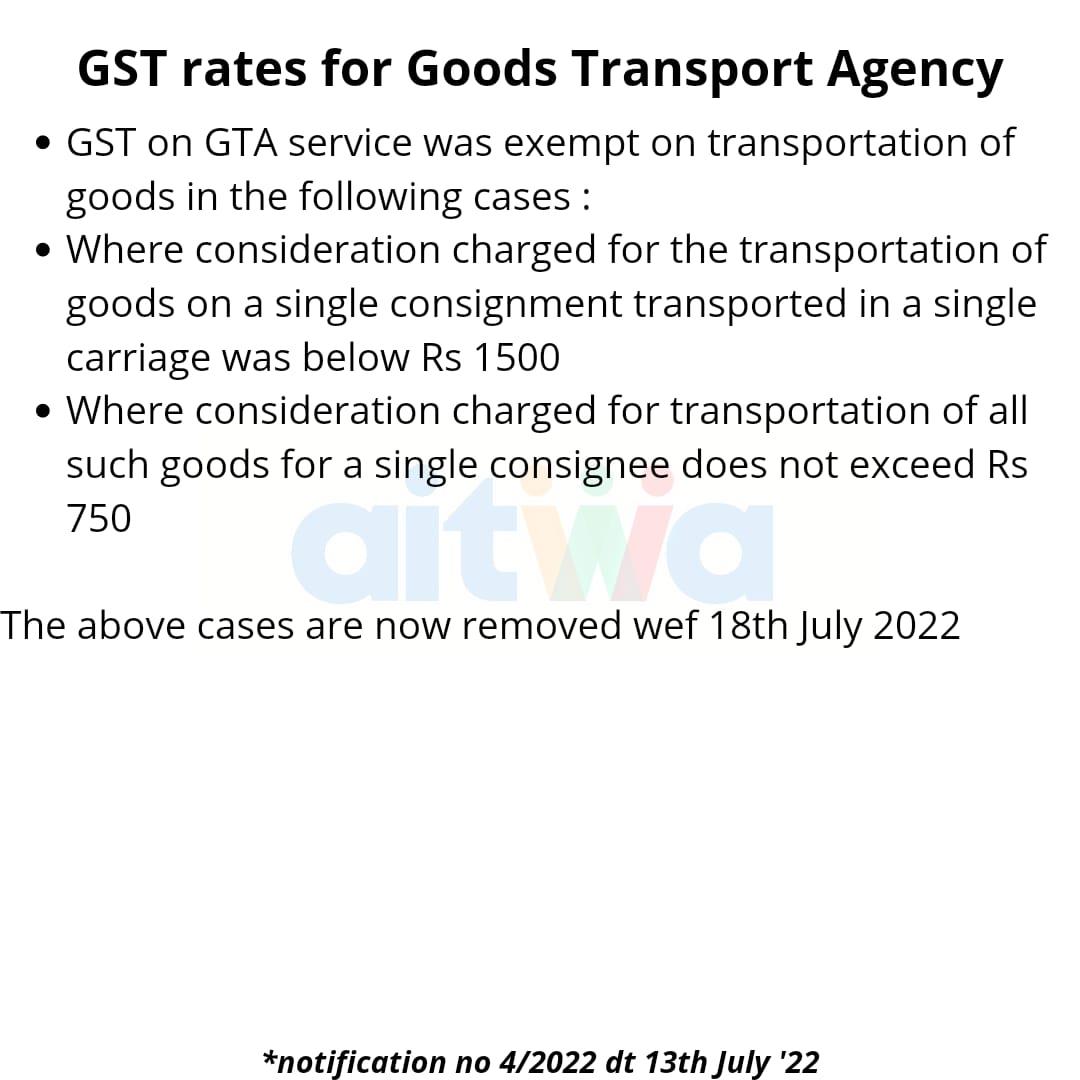

Please note, Now GST is applicable on fright from ₹1. No Exceptions.

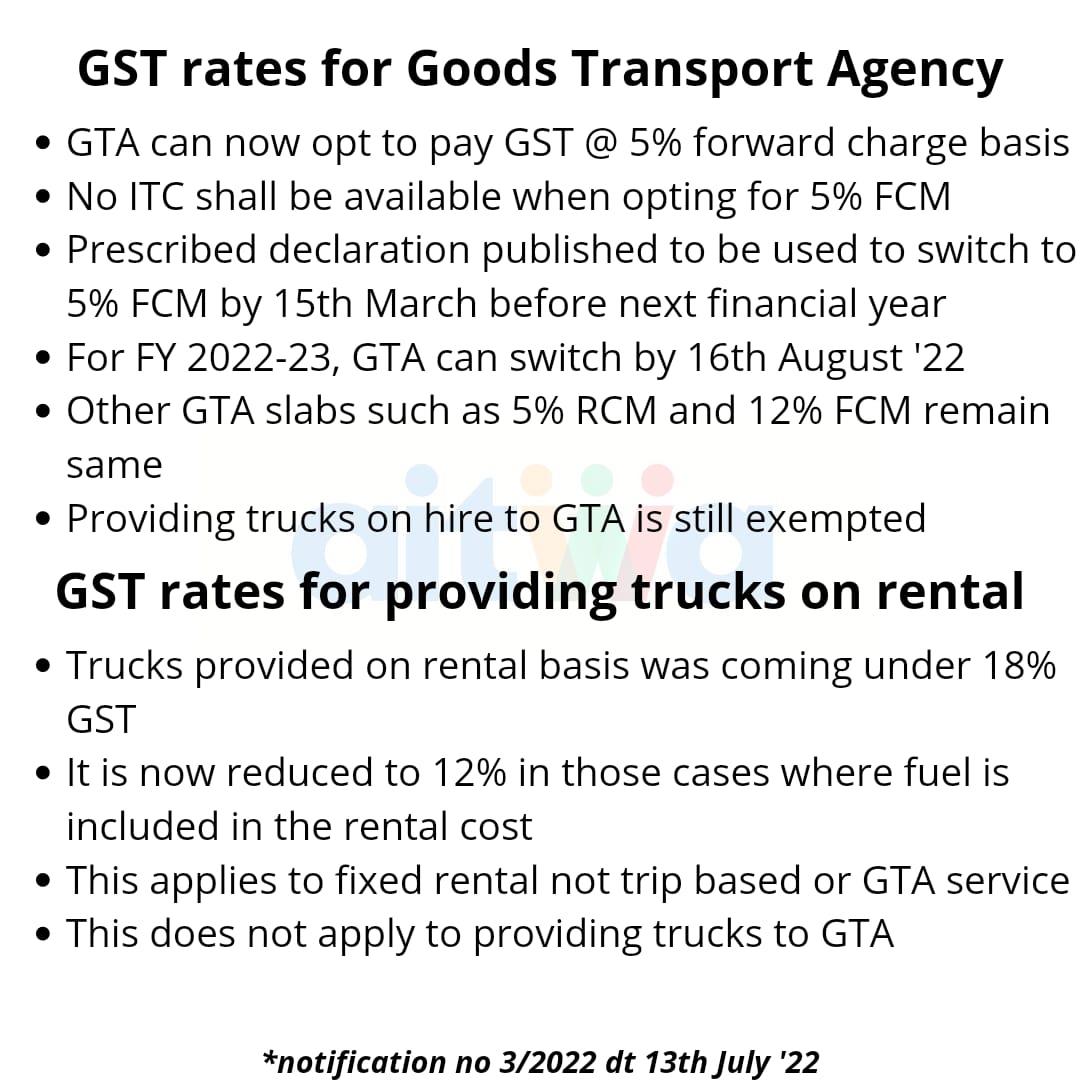

GST rates for Goods Transport Agency

- GTA can now opt to pay GST @ 5% forward charge basis.

- No ITC shall be available when opting for 5% FCM • Prescribed declaration published to be used to switch to 5% FCM by 15th March before the next financial year.

- For FY 2022-23, GTA can switch by 16th August '22.

- Other GTA slabs such as 5% RCM and 12% FCM remain the same

- Providing trucks on hire to GTA is still exempted.

GST rates for providing trucks on rental

- Trucks provided on a rental basis were coming under 18% GST.

- It is now reduced to 12% in those cases where fuel is included in the rental cost.

- This applies to fixed rental not trip-based or GTA service.

- This does not apply to providing trucks to GTA.

GST rates for Goods Transport Agency

- GST on GTA service was exempt on transportation of goods in the following cases:

- Where consideration charged for the transportation of goods on a single consignment transported in a single carriage was below Rs 1500.

- Where consideration charged for transportation of all such goods for a single consignee does not exceed Rs 750.

The above cases are now removed wef 18th July 2022.