News

1

Mar

2022

HC has clearly stated that mere expiry of eway bill cannot be considered tax evasion and thus penalizing under Section 129 is set aside.

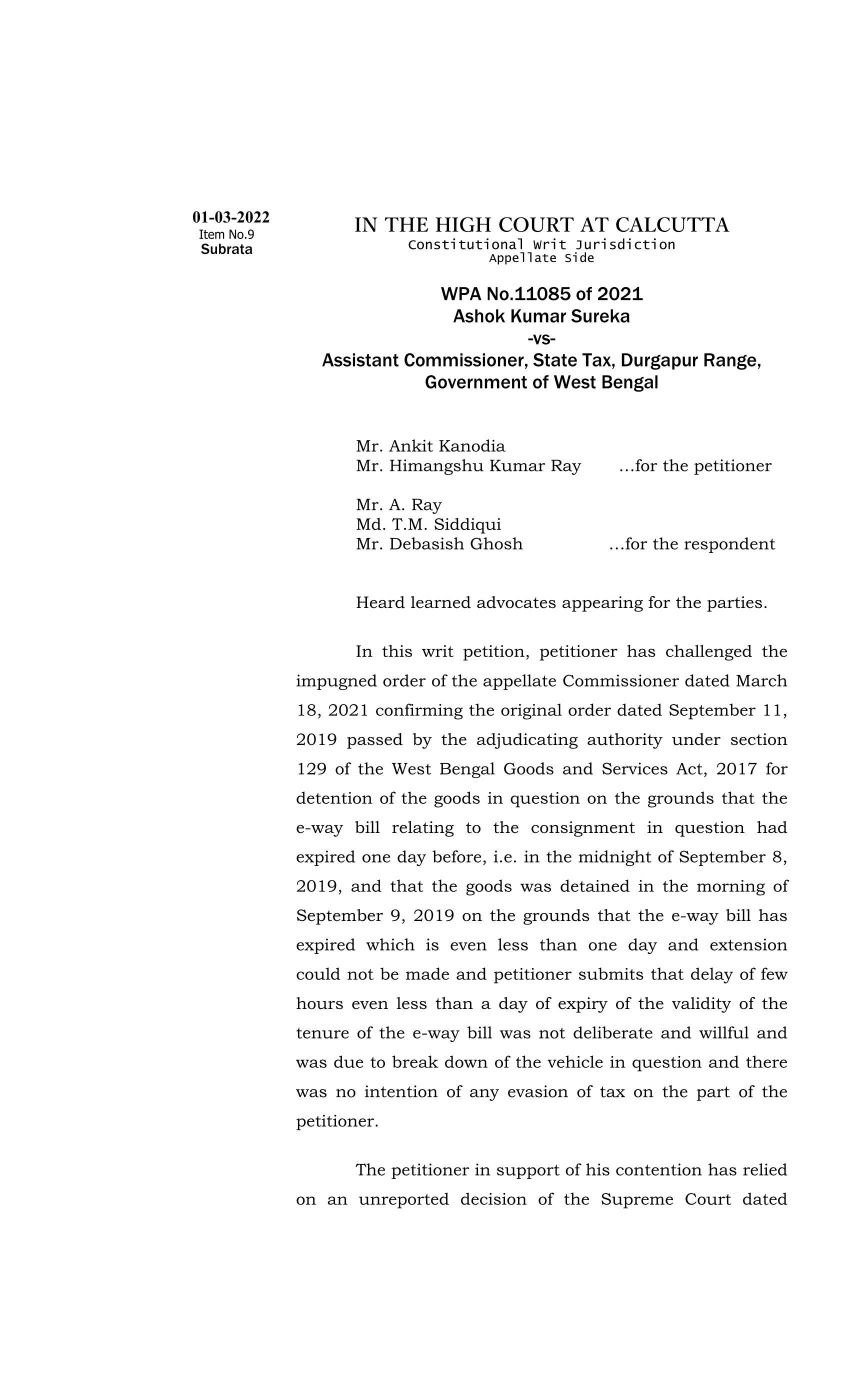

The Hon High Court of Calcutta, on 1st March 2022, has ordered in favour of the taxpayer where a consignment in a truck was intercepted next day of expiry of eway bill. It was penalized under the draconian Section 129 of GST for expired eway bill. HC has clearly stated that mere expiry of eway bill cannot be considered tax evasion and thus penalizing under Section 129 is set aside.

For easy reference of the transport fraternity the relevant order copies and other eway bill related information is available on http://bit.ly/ewaybillrefs