News

14

Jan

2019

Retirement age for commercial vehicles may be fixed at 20 years ..

NEW DELHI: A policy that proposes to take hundreds of thousands of polluting commercial vehicles off the road is likely to go for cabinet clearance soon.

Under the plan, vehicles that are 20 years and older will stop plying from 2020, helping to curb emissions and boosting demand for new vehicles.

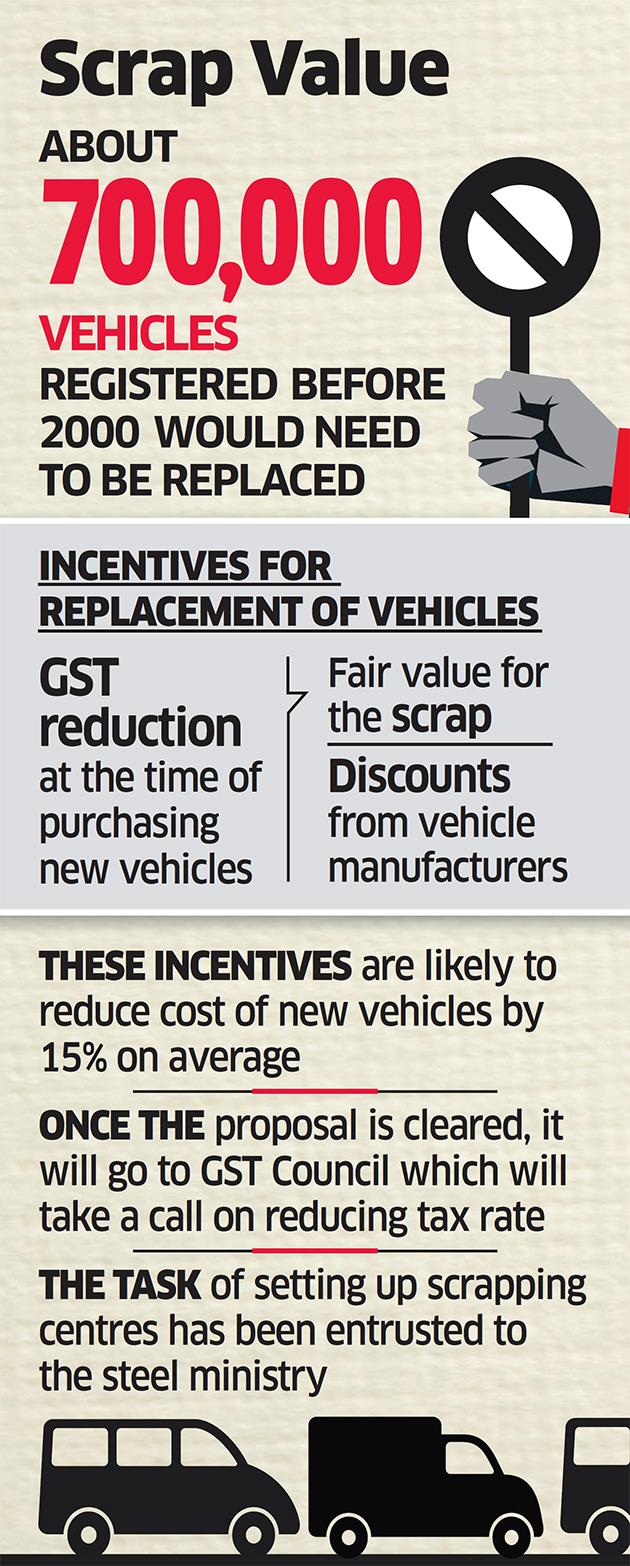

“We have proposed to fix 20 years as the lifetime for commercial vehicles. The vehicle scrapping policy will come into force from 2020, after which any commercial vehicle that completes 20 years would go off the road,” a top government official said. “We are hoping to get the cabinet’s nod soon.” There are 700,000 commercial vehicles registered before 2000 that are currently on the roads. The policy proposes to make pre-2000 commercial vehicles eligible for incentives if they are replaced by new ones. Vehicular emissions are among the key reasons for the foul air in India’s big cities that stunts growth among children and leads to respiratory and other diseases.

Under the plan, vehicles that are 20 years and older will stop plying from 2020, helping to curb emissions and boosting demand for new vehicles.

“We have proposed to fix 20 years as the lifetime for commercial vehicles. The vehicle scrapping policy will come into force from 2020, after which any commercial vehicle that completes 20 years would go off the road,” a top government official said. “We are hoping to get the cabinet’s nod soon.” There are 700,000 commercial vehicles registered before 2000 that are currently on the roads. The policy proposes to make pre-2000 commercial vehicles eligible for incentives if they are replaced by new ones. Vehicular emissions are among the key reasons for the foul air in India’s big cities that stunts growth among children and leads to respiratory and other diseases.

“Certain incentives are being worked out for people who will scrap their vehicles,” the official added. The task of setting up scrapping centres has been entrusted to the steel ministry. Three incentives have been planned. These include a reduction in the goods and services tax (GST) at the time of purchasing new vehicles, fair value for the scrap and discounts from vehicle manufacturers.

These incentives are likely to reduce the cost of new vehicles by 15% on average. “After the proposal is cleared by the cabinet, it will go to the GST Council, which will take a call on reducing the tax rate on replaced vehicles,” the official said. The road transport and highways ministry had released the first draft of the policy in 2016, proposing a life of 15 years for commercial vehicles.

A committee of secretaries set up to work out the details of the policy decided that it should be made mandatory for 20-year-old vehicles. Those opting for replacement must deposit the vehicle documents at recycling centres. “After verification, the owner will get a certificate and the price for the scrap. He has to provide the certificate to the dealer while buying the new vehicle to avail of the discount and tax incentive,” an official said.

These incentives are likely to reduce the cost of new vehicles by 15% on average. “After the proposal is cleared by the cabinet, it will go to the GST Council, which will take a call on reducing the tax rate on replaced vehicles,” the official said. The road transport and highways ministry had released the first draft of the policy in 2016, proposing a life of 15 years for commercial vehicles.

A committee of secretaries set up to work out the details of the policy decided that it should be made mandatory for 20-year-old vehicles. Those opting for replacement must deposit the vehicle documents at recycling centres. “After verification, the owner will get a certificate and the price for the scrap. He has to provide the certificate to the dealer while buying the new vehicle to avail of the discount and tax incentive,” an official said.